Reach The Right Investors With The Power of Technology

Harness the power of technology to automate your investor recruitment process and keep your calendar full of calls with warm investor leads.

Sample Deal

123 Main Street, Houston TX

Asset: Multi Family

Multifamily is residential real estate that contains more than one housing unit, or several buildings within one complex.

Hold Period: 5 Years

The duration of the investment, and time period an investment must be held by investors without liquidation.

Min. Investment: $150,000

This is the minimum required investment amount for this deal.

Return on Investment: 210%

Multifamily is residential real estate that contains more than one housing unit, or several buildings within one complex.

Cash on Cash: 8%

Cash-on-cash measures the annual cash income earned; calculated by dividing the pre-tax cash flow by the total cash invested.

Average Annual Return: 22-25%

Average Annual Return (AAR) is a measure of the average amount of money earned per year; calculated by dividing the total returns earned over time by the hold period.

Internal Rate of Return: 18-21%

Internal Rate of Return (IRR) is the annual compounded rate of return that accommodates the time value of money; also, the rate at which the net present value is equal to zero.

Equity Multiple: 2.10x

Equity Multiple (EM) is calculated by dividing total returns by the total equity invested. i.e a 2.5X equity multiple implies an investor can expect to receive $2.50 on every $1 invested.

At a Glance

The Sample is a 2006-vintage built apartment complex in one of the most desirable submarkets in Houston, TX! A 350-unit, class A, quality-product, The Sample features a beautiful architectural built and amenity package, and still has value-add opportunity via unit turnovers, rent increases, and capitalizing on additional income generating channels.

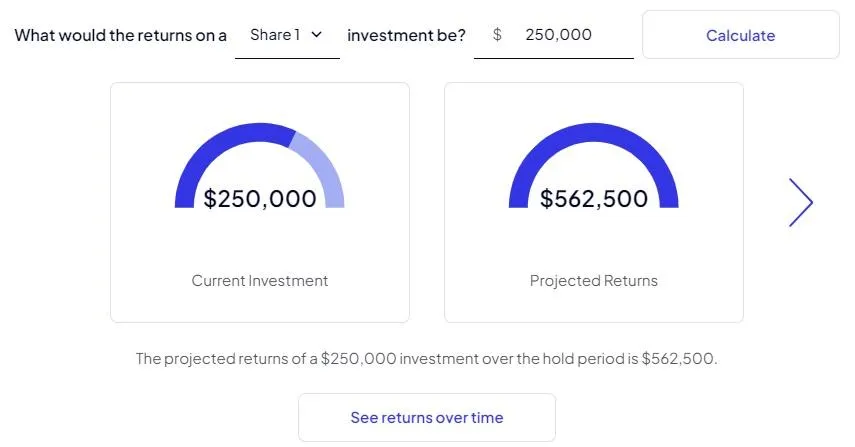

Returns

First Distribution Date: 05/06/24

The date at which you can expect to receive your first rental dividends.

Frequency: Quarterly

The duration of the investment, and time period an investment must be held by investors without liquidation.

Cash Flow: $2,500

The estimated amount of rental dividends that you can expect to receive at each distribution date.

Cash on Cash Return: 7%

Cash-on-cash (COC) measures the annual cash income earned; calculated by dividing the pre-tax cash flow by the total cash invested.

Returns Summary

A short summary about rental dividends can go here. A short summary about rental dividends can go here. A short summary about rental dividends can go here. A short summary about rental dividends can go here.

Business Plan

First Distribution Date: 05/06/24

The date at which you can expect to receive your first rental dividends.

Frequency: Quarterly

The duration of the investment, and time period an investment must be held by investors without liquidation.

Cash Flow: $2,500

The estimated amount of rental dividends that you can expect to receive at each distribution date.

Cash on Cash Return: 7%

Cash-on-cash (COC) measures the annual cash income earned; calculated by dividing the pre-tax cash flow by the total cash invested.

Business Strategy

The Sample is a 2006-vintage built apartment complex in one of the most desirable submarkets in Houston, TX. A 350-unit, class A, quality-product, The Sample features a beautiful architectural built and amenity package, and still has value-add opportunity via unit turnovers, rent increases, and capitalizing on additional income generating channels.

Targeted Rents & Sales Price

Scroll through the sections to learn more about how the business plan affects the asset’s rental income, net operating income and ultimately the targeted sales price.

Replace Image below with similar navigation-based charts using chartjs.org

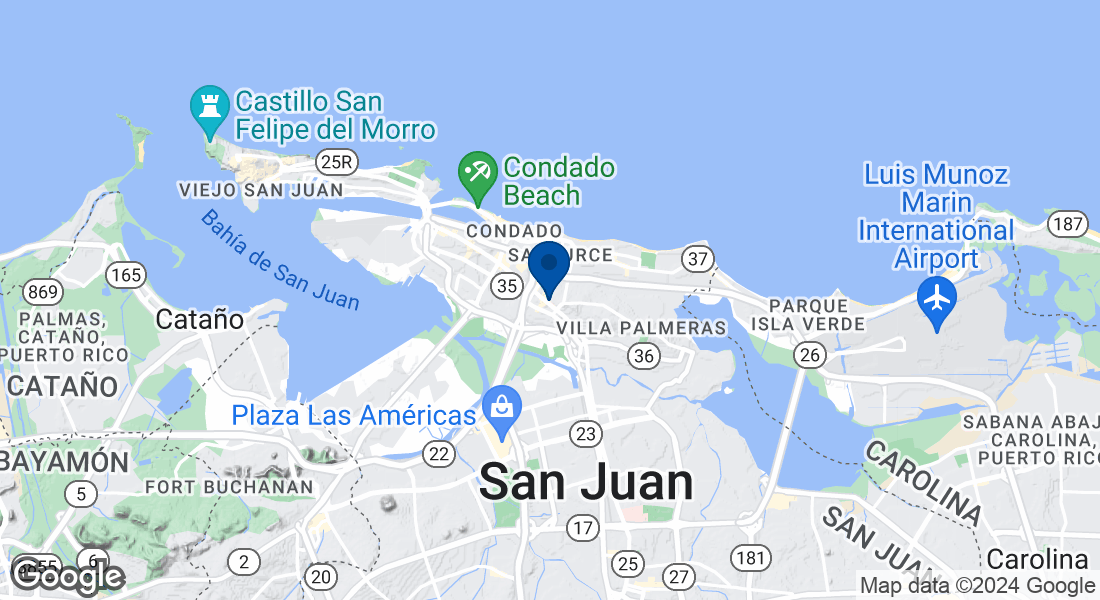

The Market

Houston, Texas, the fourth largest-city in the U.S., is experiencing robust growth in populations, employment, and apartment occupancy. With a population of over 2.3 million and a metropolitan area of over 7 million, the city is among the nation's fastest-growing. It's diversified economy, including energy, healthcare, and technology sectors has led to a thriving job market, contributing to the strong demand for housing. Houston stands as a promising market with potential for further growth.

Population Growth

The population has grown by 3-5%.

Employment Growth

Employment has grown by 96%.

Rental Occupancy

Rental occupancy is currently 89% on average.

The Team

Capital Media is a private-real estate firm that focuses on helping clients achieves superior, risk adjusted returns through the acquisition of multifamily complexes, while emphasizing affordable housing for residents. Since 2012, the team has acquired over 100 million in assets, and has an in-house property management team working skillfully to drive resident satisfaction and investors returns. Mission consistently strives to be a leader in the multifamily investment, and reHeadlineal estate education space.

Milestones to Date

100 M

Assets Under Management

23

Acquisitions

30.5%

IRR Track Record

15

Exited Transactions

Team Member

Capital Media is a private-real estate firm that focuses on helping clients achieves superior, risk adjusted returns through the acquisition of multifamily complexes, while emphasizing affordable housing for residents. Since 2012, the team has acquired over 100 million in assets, and has an in-house property management team working skillfully to drive resident satisfaction and investors returns. Mission consistently strives to be a leader in the multifamily investment, and real estate education space.

Team Member

Capital Media is a private-real estate firm that focuses on helping clients achieves superior, risk adjusted returns through the acquisition of multifamily complexes, while emphasizing affordable housing for residents. Since 2012, the team has acquired over 100 million in assets, and has an in-house property management team working skillfully to drive resident satisfaction and investors returns. Mission consistently strives to be a leader in the multifamily investment, and real estate education space.

Team Member

Capital Media is a private-real estate firm that focuses on helping clients achieves superior, risk adjusted returns through the acquisition of multifamily complexes, while emphasizing affordable housing for residents. Since 2012, the team has acquired over 100 million in assets, and has an in-house property management team working skillfully to drive resident satisfaction and investors returns. Mission consistently strives to be a leader in the multifamily investment, and real estate education space.

Financing

Loan to Cost (LTC): 70%

Loan Term: 5 Years

Interest Only Period: 3 Years + (2) one-year extensions

Interest Rate Today: 5.8%

Sponsorship chose this structure as it is most suitable for the capex plan in place. Additionally, the lender has the ability to refinance to a permanent loan when ready, and the loan will not be sold on the secondary market; offering more flexibility and certainty for investors.

Tax Advantages

Real estate depreciation is a valuable incentive investors can use to significantly reduce taxable net income.

At $250,000 invested, roughly $175,000 - $200,000 can be written off from your first-year taxable passive income due to bonus depreciation.

What is bonus depreciation ?

A tax incentive that allows investors to deduct a large percentage of capital improvements in the same tax year the expense is incurred, instead of over the asset’s useful life; resulting in substantial tax advantages in the first year of taxable income.

Note: This is for informational purposes only and not professional tax advice. Please consult with your CPA for the most accurate figures and eligibility.

Offering Details

Property Purchase Price: $34,000,000

Property purchase price is the price at which the asset has been purchased.

Total Property Cost: $50,000,000

The total property cost is the total costs required for the acquisition and property improvements.

Offering Size: $15,000,000

The offering size is the total amount of capital being raised, and offered to investors as securities.

Price Per Share: $1,000

Price per share is the price paid per share, according to the offering plan.

Total Shares: 15,000

Total shares is the total amount of shares being offered for purchase, according to the offering plan.

Offering Type: Reg D 506(c)

Total shares is the total amount of shares being offered for purchase, according to the offering plan.

Documents

FAQs

Will there be a refinance?

Yes, we are planning to refinance the asset in year 3, assuming all goes accordingly with our capital improvements plan.

How often will distributions be paid?

Distributions will be paid out quarterly to investors, beginning from the second quarter upon closing.

What tax documents should I expect to receive?

K-1s will be uploaded to your profile in the investor portal, where they are available for download. Our goal is to deliver K-1s on, or before, the deadline of 3/15 each year.

IMPORTANT MESSAGE: This website is a website owned and operated by InvesTechs PR, LLC dba Capital Advisory Ai (“Us/We/Our/Company”). By accessing the website and any pages thereof, you agree to be bound by the Terms of Service, Privacy Policy , and Disclosures, as each may be amended from time to time. We are not a registered broker, dealer, investment advisor, investment manager or registered funding portal. Prospective investors are advised to carefully review Our private placement memorandum, operating agreement and/or partnership agreement, and subscription documents (“Offering Documents”) and to consult their legal, financial and tax advisors prior to considering any investment in the Company, one of its subsidiaries or affiliates. Sales of any securities will only be completed through the Company’s Offering Documents and will on be made available to “Accredited Investors” as defined by the Securities and Exchange Commission (“SEC”). Generally, an Accredited Investor is a natural person with a net worth of over $1 million (exclusive of residence) or income in excess of $200,000 individually or $300,000 jointly with a spouse. The securities are offered in reliance on an exemption from the registration requirements of the Securities Act of 1933, as amended, and are not required to comply with specific disclosure requirements that apply to registration under the Securities Act. Neither the SEC nor any state regulator has reviewed the merits of or given its approval to the securities, the terms of the offerings, or the accuracy or completeness of any offering materials. The securities are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell their securities. All forward-looking statements address matters that involve risks and uncertainties and investors should be able to bear the loss of their entire investment. All investors should make their own determination of whether or not to make any investment, based on their own independent evaluation and analysis. Past performance is not indicative of future returns or Fund results. Individual investment performance, examples provided and/or case studies are not indicative of overall returns of the Company. In addition, there can be no guarantee of deal flow in the future. Forward looking statements are not statements of historical fact and reflect the Company’s views and assumptions regarding future events and performance.

All Rights Reserved Capital Advisory Ai 2024

LinkedIn

Facebook

Youtube